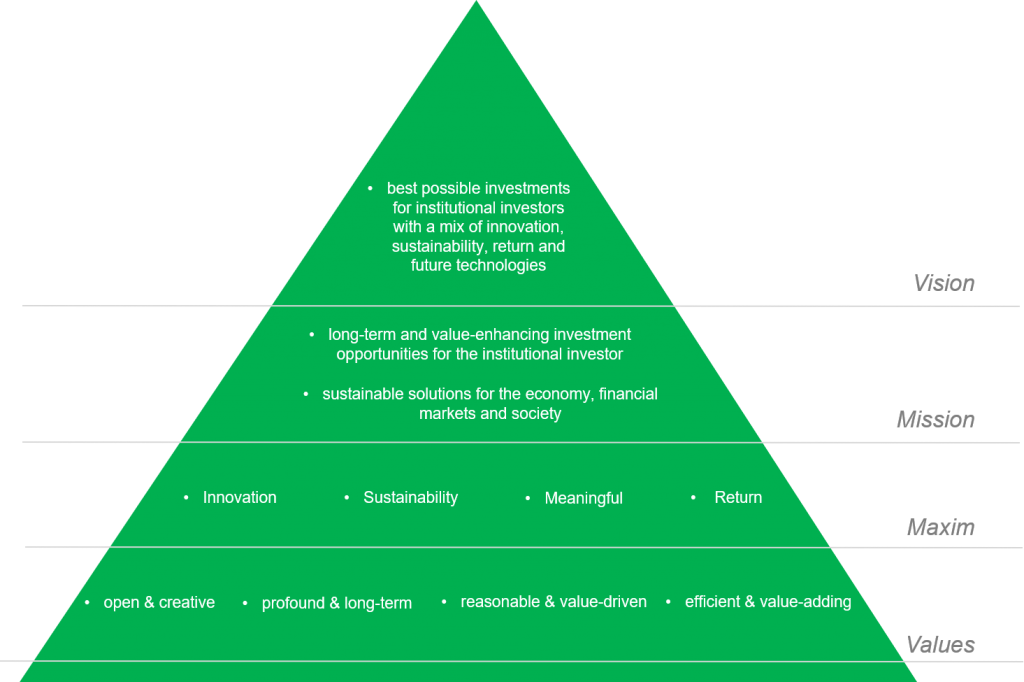

artis enables institutional investors to make optimal investments that are characterised by a balanced mix of return, sustainability and future viability.

The focus lies on high-quality, attractive investment opportunities for institutional investors as well as sustainable solutions for the economy, financial markets and society.

The foundation of our daily actions is based on the four values of innovation, sustainability, meaningfulness and returns. These values are part of the “artis DNA” and an integral part of our employees’ daily actions. Our four attributes and our message of providing “sustainable financial solutions for the economy, financial markets and society” have existed since the company was founded. In particular, sustainable environmental and climate protection is a central issue of artis.

We therefore follow the conventions and guidelines of national (ESG categories of BaFin) and international organizations (UN Global Compact, SDG goals, UN Guidelines on Business and Human Rights, etc.) and are constantly developing. These are taken into account, both internally and in the selection of our product partners and products. All of our cooperation partners’ investment solutions offer a minimum level, many even the highest industry standards, in the area of sustainable capital investment.

Our primary goal is to steadily reduce company-related CO2 emissions and to develop into a climate-neutral company as soon as possible. Specifically, this includes the reduction of energy consumption, progressive digitalization in the direction of a “paperless office” as well as environmentally friendly business trips.

artis and its employees support social, environmental and corporate commitments in various regional and international projects and associations.

Placement agent – a new technical term in the lexicon of the financial industry, the dimension of which is becoming increasingly familiar to many asset management companies and institutional investors. The positive aspects of this relatively new service in German-speaking countries are gradually being recognised. Institutional investors expect professional strategies as well as a pre-selection of certain subject areas. Product providers, on the other hand, are increasingly dispensing with expensive sales staff (pressure on margins) and concentrating more on the product design and implementation of their services.

Renowned asset manager from Europe, America, Asia and Australia want to open up markets such as the German-speaking countries. We support asset management companies in all phases of market development and assist first-class fund managers in the analysis and implementation of sales and marketing strategies in Germany, Austria and Switzerland. Foreign asset management companies often lack country-specific knowledge as well as the know-how of the investment and risk requirements of local investors. The lack of a network for client acquisition is often a further shortcoming that can be elegantly compensated for with the support of a placement agent.

The interest of institutional investors in investments in real assets and liquid alternatives remains strong and signals high growth rates and investment needs on the part of institutional investors in the coming years. Asset allocation has changed in favour of alternative investment strategies. The desire for attractive returns, broader diversification, greater risk reduction and the difficult interest rate environment are just some of the many reasons why institutional investors are looking at new asset classes. We are a specialist consultant who will generate added value for institutional investors, especially in the real assets and liquid alternatives segments. artis supports institutional investors in identifying their needs and successfully implementing them in investment strategies.

We help investors with manager search, risk identification and structuring, just to name a few examples. We offer a large network on the side of the fund providers as well as a high reputation of the players. In addition, the people at artis have a high level of expertise in research and competitive analysis. Neutrality and independence in the interests of our clients towards the asset management companies are fully guaranteed.

studied economics, business administration and mechanical engineering at the Technical University of Darmstadt and is now an executive consultant, supervisory board and advisory board member in the real estate and funds sector. He is also involved in various companies and projects as an entrepreneur and founder. With more than 30 years of experience (from 1992 to 2011 he was a Partner at FERI, most recently as a member of the Executive Board of FERI AG and as CEO of FERI EuroRating Services AG), he has a large network, know-how and experience in the areas of real estate, real assets and funds.

is a founding partner and managing director of artis Institutional Capital Management GmbH. He has 30 years of experience in asset management and sales with institutional investors and family offices – in both liquid and illiquid asset classes. This includes fixed income, equities, real estate, commodities, private equity, private debt and infrastructure. His previous positions, both nationally and internationally, were with Deutsche Bank (1984-1986), Schweizerischer Bankverein (1987-1992), Prudential-Bache (1992-2003), LB Immo Invest (2003-2008), GAM, formerly Bank Julius Bär resp. Swiss & Global Asset Management (2008-2016) and AREAS Institutional Capital Management (2016-2018).

is a lawyer in Frankfurt am Main and Partner of an international law firm. For years, he is a recognized specialist for transactions in the areas of M&A and venture capital with an industry focus on technology companies (recognized in the trade press such as JUVE, Handelsblatt/Best Lawyers, Legal 500). His clients include international companies, well-known institutional investors, start-ups and family offices, a significant number of which are based in the Middle East and South Asia.